KOIFINANCE

KOIFINANCE: Revolutionizing DeFi with Cutting-Edge Features and a Visionary Roadmap

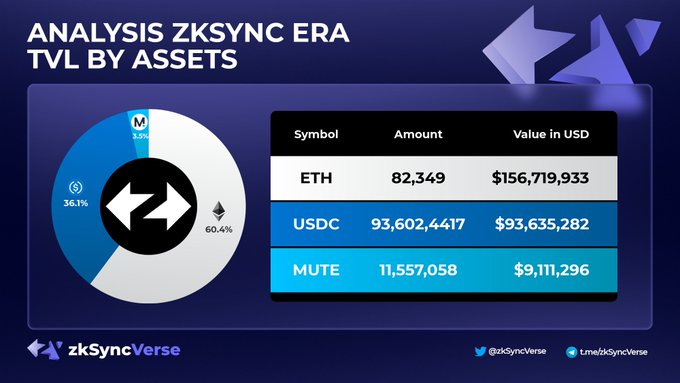

Significant contributions were made by zkSync Era in the creation of the zkRollup DeFi Platform, often referred to as Koi. This platform is widely considered to be one of the most comprehensive platforms. On one completely decentralized, community-managed, and community-driven platform, you have the ability to invest and trade, earn yield, and participate in bond transactions. All these activities can be done on one platform. Leveraging Ethereum allows you to take advantage of the security that Ethereum provides without having to pay the high gas rates that are now in effect. This is made possible by the fact that Ethereum.

Koi Finance's main goal in creating the KOI token is to facilitate transactions and interactions within its ecosystem. As a DeFi platform, Koi Finance serves as a liquidity center for all projects on zkSync. They offer a fast and efficient exchange mechanism, with very low fuel costs.

Swimming Pool Layout

1. Koi is designed to have a dynamic configuration for Liquidity Pools, which allows the use of stable and normal AMM curves. This is the motivation for developing Koi.

2. The stable group consists of commodities that are traded within a certain price range. A good example is USDC/DAI.

Examples of assets held in Normal Pool include Ethereum and Bitcoin, both of which can be traded without any connection.

It is possible to have a Normal pool and a Stable pool with the same assets. Both have the same characteristics. Koi will find deals that provide the best quality at the most affordable prices, regardless of pond type.

There are differences in the costs associated with each group compared to the costs associated with the other groups. The following are the minimum and maximum fees that can be charged for each type of pool that can be determined by the LP:

Unchanged: 0.01% to 2%

Normal range: 0.01% to 10%

A SWIMMING POOL THAT IS NOT VULNERABLE TO INSTABILITY

Assets that are intended to be included in a stable pool are those that should trade within a certain price range on a regular basis. This allows products that are exchanged in high volumes to be exchanged in an efficient use of capital. Given the fact that trading prices continue to maintain narrow margins after pricing is established at the time of pool construction, it is critical to develop appropriate pricing for these pools.

(x3 ∗y)+(y3∗x)≥k

This is a typical set

Assets included in the normal pool are assets that are not interconnected and have prices that can be adjusted. Most trading pairs are handled by this pool, which uses the common AMM algorithm. This pool is used for trading pairs.

x∗y≥k

DYNAMIC SWIMMING POOL

It is possible to create pools with LP fees that range from 0.01% to 10% for standard pools and 2% for stable pools. Koi make it possible to create ponds. Once set at the time of pair formation, the fee can only be changed through the LP's governance mechanisms. There is always the possibility for LP providers (or delegated providers) with a voting weight of fifty percent or more to change these fees. Every time the pool fee is changed, there is a 0.1% tax on the total votes. These prices are in place to prevent people from gaming the system. Therefore, it is impossible for flash loans to change their price structure without incurring losses.

Many initiatives in the cryptocurrency and decentralized finance industry can benefit from powerful systems and tools thanks to the simplicity of dynamic fee pools with governance.

GAME THEORY

Based on observations of conventional CEX markets and even most NFT markets, it is common for market makers (spreads) and content producers and teams (nfts) to charge fees of one percent or more from their customers. This pricing system allows not only individual LP providers, but also projects concentrating on Protocol Owned Liquidity (POL) to set base fees for their pairs. This will allow them to gain a larger revenue stream for the project, compared to what they can earn from most conventional AMM-based DEXs. Additionally, this fee system must empower each LP provider.

Roadmap

Big picture roadmap — subject to change at any time

Solutions

Major Network Release

May 2023.

Agriculture Program

The liquidity rewards protocol was launched to incentivize high-value projects to provide liquidity on Koi. Improved APY farming model allowing for efficient reward distribution.

Bond Infra

The Bond Market was launched to provide tools for projects to improve their PoL.

Paymaster

Pay a fee for each token traded on Koi

veDAO

Sound escrow model for Koi tokens. Get access to KOI DAO, increased farming APY, and profit sharing (Q1 2024)

Q1/Q2 2024

Mute -> Koi rebrand & token swap

Rebranded ecosystem with overhauled tokenomics

veKoi revenue sharing

Integrate a revenue sharing mechanism from protocol generated fees for veKoi locker.

Concentrated liquidity pools, limit orders, trading strategies

Implement and integrate concentrated liquidity pools with overlapping limit orders, range orders, repeat orders, and liquidity segmentation.

conclusion

KOI token is one of the interesting assets in the crypto world. Bounty campaigns are an effective strategy in promoting cryptocurrency projects. Through bounty campaigns, projects can expand the reach and awareness of their tokens. The bounty campaign also helped build public confidence in the project. The advantages of bounty campaigns include wider token distribution and affordable fees.

For further information visit:

WEBSITE: https://koi.finance/

WHITE DESCRIPTION: https://wiki.mute.io/mute/info/tokenomics-1

TWITTER: https://twitter.com/koi_finance

TELEGRAM: https://t.me/mute_iol

Discord: https://discord.com/invite/muteio

Forum Username: Deddiecorbujer

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3428154

Komentar

Posting Komentar